Feb 19, 2024

A Beginner's Guide To Digital Wallets

Posted by : the ENTERTAINER Admin

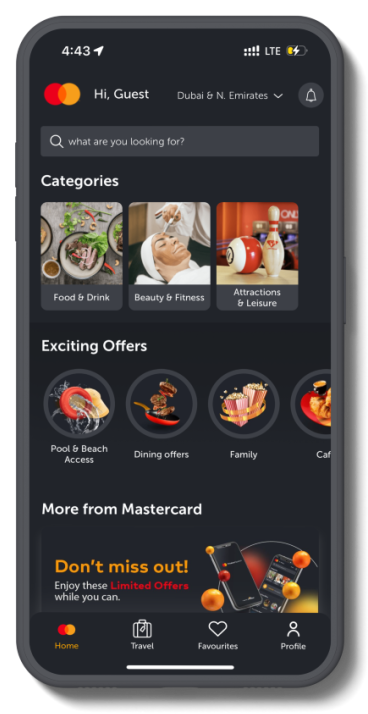

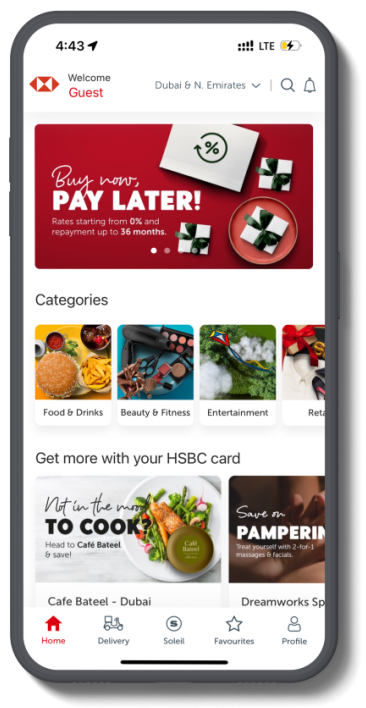

Over the past couple of years, there has been a steady increase in the popularity and usage of digital wallets. You might have noticed your friends and family using Apple Pay, Google Pay, PayPal, Venmo and other digital wallets for various transactions.

A recent report by Square also indicates that the pandemic has led to a major increase in cashless payments as more people have started to sway toward digital payment options due to health and safety concerns.

What is a digital wallet?

It’s exactly what it sounds like – a digital wallet consisting of your financial accounts that is easily accessible on your mobile, computer and other smart devices.

No one likes a bulky wallet or having to rummage around their purse for their debit or credit card when they’re out and about - thanks to digital wallets this will soon be a thing of the past. With a digital wallet, you can have instant access to your finances and make virtual payments on the go: Any time, anywhere!

Is it safe?

When you think about your finances, it’s only logical to want to ensure all the details pertaining to your account remain safe and secure.

So, what would happen if you misplace your phone, or someone steals it? Should you be worried about hackers gaining access to your digital wallet? Does it mean your finances are at high risk? In a nutshell, no – because mobile payments are heavily encrypted and tokenized which means they are more secure compared to physical credit and debit cards.

How does it work?

After you update your digital wallet with your personal information, the data entered is then encrypted into a unique code. Only authorized entities will have access to it. Thanks to tokenization, all the sensitive encrypted data is swapped with tokens. Each time you make a purchase, a unique token is generated and used – the best part is only the merchant’s payment gateway is able to match this token and thereby accept the payment.

Additionally, user verification (facial recognition, fingerprint or PIN) provides an added layer of security in relation to your identity and personal details.

What can you store in a digital wallet?

Here are some of the things you can store in a digital wallet:

Loyalty rewards cards.

Credit or debit cards.

Concert tickets.

Boarding passes.

Gift cards.

Coupons.

Final takeaway:

Given that the demand for contactless experiences has increased drastically during the pandemic and there is a continued upward trend with the global online shopping market set to hit $5.4 trillion by the end of 2022 – this strongly suggests that digital wallets are the wave of the future.

If you’re looking for a highly efficient, user-friendly and secure method for online payments, loyalty rewards and more, then digital wallets may just be the right option for you.

For press inquiries, please contact:

Penny McNmara, Head of Marketing

Mobile: +971 58 590 1510

Email: [email protected]

Website: www.theentertainerme.com

Copyright © 2024 the ENTERTAINER business. All Rights Reserved